Life insurance is like pizza — it comes in many styles and the customization options are practically endless. But unlike pizza, it’s cost-prohibitive to sample life insurance policies to pick the one you like. And that means you’ll have to know your options and clarify your financial goals to land on the type of life insurance that’ll work for you.

What are the Different Types of Life Insurance?

While life insurance comes in many forms, you can categorize all of them into one of two buckets. And no, it’s not pan or regular crust. The first two life insurance types to know are term life and permanent life.

Term life insurance

Term life insurance is a simple and affordable option that pays a death benefit to your beneficiaries if you pass while the policy is in force. It’s called “term,” because the coverage is active for a specific time period. When that term ends, you can renew the policy for another term or allow the coverage to lapse. Some policies may give you the option of converting your term insurance into permanent life insurance, which has additional benefits.

Term life premiums are based on your age, gender, and health. The desired death benefit, also known as the policy’s face value, plays a role as well. For large face values, the insurer will ask you to submit a medical exam with your application. Often, the insurance company can send a medical professional to your home to ask you a few questions, take down your blood pressure and pulse, and collect blood and urine samples.

There are three common ways insurers can structure premiums for term life insurance.

- A “level-premium” policy is the most straightforward option, with a fixed death benefit and a fixed annual premium. The term of coverage can range from 10 to 30 years.

- Another option is a yearly renewable policy, which has a fixed death benefit and a term of one year. You can renew the policy every year, but the premiums are not fixed. As you get older, the premium goes up.

- Lastly, the most affordable option is a decreasing term policy. The premium is fixed for the term of coverage, but the death benefit goes down over time. Decreasing term life insurance is appropriate for families that have high debt when the policy is initiated. The policy could be structured specifically to pay off a mortgage, for example, to ensure the remaining family members can keep their home if something happens to the breadwinner. As the family pays down the mortgage balance, the death benefit would reduce also.

Permanent life insurance

As the name implies, permanent life insurance is intended to cover you for your lifetime — assuming you pay the premiums on time. In addition to the death benefit, permanent life policies also have a savings component called “cash value.” Cash value is invested according to your policy type and accumulates on a tax-deferred basis over time. Eventually, you can access those funds by withdrawing or borrowing from your policy.

Relative to term life, a permanent life policy will have much higher premiums. That’s because those premiums fund the cash value, as well as the policy’s administrative costs and death benefit.

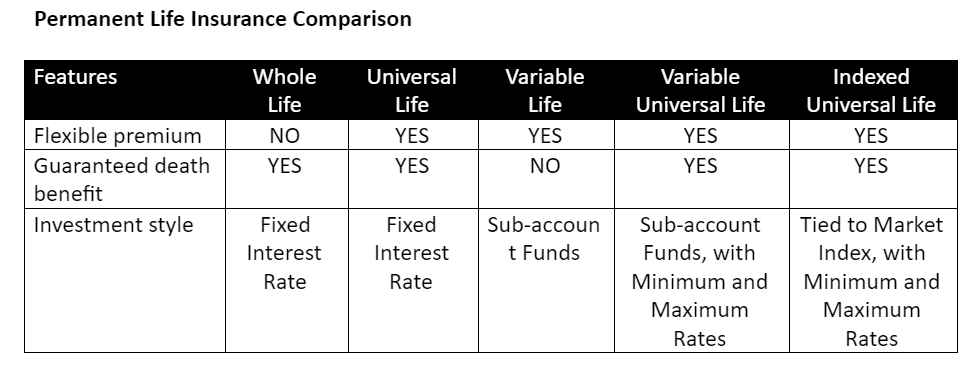

Permanent life insurance comes in several types, including whole life, universal life, variable life, variable universal life, and indexed universal life.

Whole life insurance

Whole life insurance is a straightforward form of permanent life coverage. The death benefit and annual premium are fixed, and the cash value earns interest at a fixed rate. Some whole life policies also earn dividends. These can be cashed out or left in the account to increase the policy’s cash-value growth. You could also increase your cash-value growth by paying more than the required minimum premium.

You can access your whole life cash value by taking a withdrawal or borrowing from the policy. Either transaction would be tax-free as long as you don’t take out more cash than what you’ve paid in premiums. Loans from life insurance usually carry a very competitive interest rate, but they do reduce the death benefit until the funds are repaid.

Whole life used to be the most common form of permanent life insurance, but its popularity has waned in recent years. In 2017, whole life policies represented 57% of permanent policies sold. By 2019, that number had declined to 30%.

Universal life insurance

Universal life, also called adjustable life, offers more flexibility than a whole life policy. As with whole life, the coverage provides for a death benefit and the accumulation of cash value. But as a policyholder, you have some control over what you pay in premiums. You can pay the minimum, which keeps the policy and the death benefit in force. Or you can pay a higher amount, and the excess goes towards your cash value.

The cash value on a universal life policy earns interest at a fixed rate that’s specified by the insurer. As the cash value grows, you’ll have the option to increase your death benefit or lower your premium payments. You could also withdraw or borrow your cash value. Cash withdrawals from a universal life policy are taxable, though loans will not be. As with whole life, a loan against your cash value reduces the death benefit paid to your beneficiaries.

Variable life insurance

Variable life insurance has a more complex investment structure than universal or whole life policies. The cash value gets invested into “sub-accounts,” which are funds operated by the insurance company. Each fund has a defined investment style, similar to a mutual fund. That allows you to tailor the investment strategy according to your needs.

If you think of a whole life policy as a cash saving account, a variable life policy is akin to stock market investing. You have a better opportunity for higher growth, but you also risk losing cash value if the sub-accounts perform badly.

Know that the death benefit on a variable life policy does fluctuate based on how those underlying sub-accounts perform. As a policyholder, you can offset these changes by increasing or decreasing your premium payments. A higher premium payment can protect a minimum death benefit, while a lower premium payment is an option when there is excess cash value.

Your variable life investment earnings are tax-deferred, and you can borrow from a variable life policy without tax consequences. The loan will become taxable if you let the policy lapse before repaying the funds.

Variable life policies tend to have higher premiums than other forms of life insurance, due to the fees associated with managing the investment sub-accounts.

Variable universal life insurance

Variable universal life insurance combines a guaranteed death benefit with the investment-style earnings of a variable life policy. The policy may also define maximum and minimum returns. So, you can design an investment strategy that suits your needs, but the upside and downside are capped. And, while the death benefit isn’t impacted by your investment performance, your cash-value growth is.

If your cash value drops too low, you’ll have to pay in higher premiums to keep your policy active. If your investments are performing well and your cash value growth is strong, you can borrow against those funds.

Variable universal life insurance balances investment opportunity with a protected death benefit, but this comes at a cost. As with a standard variable life policy, the premiums are high, thanks to the management fees associated with the underlying investments.

Indexed universal life insurance

Indexed universal life ties the cash-value earnings to a market index, such as the S&P 500. The policy will also define minimum and maximum growth rates for your invested cash. Indexed universal life can be a more affordable way to access higher opportunities for cash-value growth. As with other universal life policies, your earnings are tax-deferred. Withdrawals are tax-free, as long as you don’t cash out more than you’ve paid in premiums.

Other Life Insurance Options

But wait…there’s more! Outside of the mainstream life insurance formats, there are also life policies and options available for very specific circumstances. Think of these like gluten-free pizza — not as popular as other choices, but still useful for the situations they address.

Simplified issue life insurance

Simplified issue life insurance has a streamlined application process. Specifically, a medical exam is not required. Instead, you’ll only answer a few questions about your medical history. This doesn’t mean you can hide medical issues from the insurer, however. The insurance carrier will look you up in medical databases to verify that your health statements are accurate. Also, simplified issue life insurance isn’t available to everyone — the insurer typically limits it to applicants under a certain age.

Guaranteed issue life insurance

Guaranteed issue life insurance does not have health restrictions or requirements; everyone who is eligible to apply gets accepted for coverage. Insurers manage their risk by charging higher premiums, provided scaled benefits, and setting a maximum age for applicants. Scaled benefits are lower in the early years of the policy and increase over time.

Final expense life insurance

Final expense life insurance is a permanent life policy that’s designed to pay specifically for funeral expenses. As such, the face value of the policy is low, less than $20,000. The beneficiary can be a loved one you trust to follow through with your intended funeral arrangements. Or, you can list your funeral home as the beneficiary.

If you are healthy, you should qualify for what’s called a “level” policy. Your premium is fixed and the full benefit is available the day you initiate the coverage. If you’ve had health issues, you might have to shop for a graded benefit policy or a modified benefit policy. Both of these enforce a waiting period before the death benefit will be paid. Should you pass away before the end of the waiting period, the insurer typically returns the premiums.

Mortgage life insurance

Mortgage life insurance is a specific form of decreasing term life insurance that’s sold by your mortgage lender. If you die before the mortgage loan is paid off, the coverage repays the outstanding debt. While this does eliminate a debt burden for your beneficiaries, it also limits their financial flexibility. The death benefit goes directly to the lender, which may not be the best option for your loved ones.

Credit life insurance

Credit life insurance is another type of decreasing term insurance. It pays off specific debts at your death. The insurance protects any co-signers on the same loan from having to absorb that liability after you’re gone. Lenders often initiate this type of insurance by structuring it into the loan. Know that federal law prohibits lenders from requiring credit life insurance, so you can deny this coverage if you don’t want it.

Accidental death and dismemberment insurance

Accidental death and dismemberment insurance, also known as AD&D, is a rider that’s added to a life or health insurance policy. AD&D specifically protects you and your family against accidents. If you die from something unrelated to illness or foul play, your AD&D coverage pays a death benefit to your beneficiary. If the AD&D rider is built into another life insurance policy, your beneficiary would get the death benefit from the main policy, plus the amount specified by your AD&D coverage.

AD&D also pays out a benefit if you suffer the loss of a limb, loss of vision, or loss of hearing in an accident. In this case, the benefit is paid to you. Your rider may specify partial benefits associated with partial losses as well. For example, you’d receive a smaller benefit if you lose 50% of your vision and a larger benefit if an accident results in complete blindness.

Joint life insurance

Joint life insurance is a type of permanent coverage that’s built for two people, usually married couples. The two of you pay one premium in exchange for one death benefit. Depending on the policy structure, that death benefit can be paid to the surviving spouse or to another beneficiary after both of you die.

Survivorship life insurance

Survivorship life insurance is a type of joint life insurance. Also known as “second-to-die” life insurance, this policy type covers two people and does not pay out a death benefit until both of you are gone. You might use survivorship insurance to pay estate taxes, to arrange for the care of a special needs child, or to create wealth for your heirs.

Comparing Life Insurance Policy Types

Term Life vs Permanent Life Insurance Types

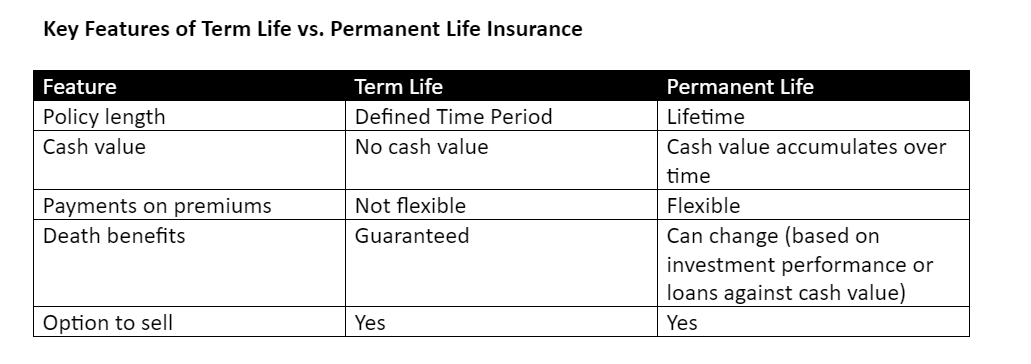

That’s the broader life insurance landscape. Now, how do you choose what’s right for you? The first decision to make is whether term life or permanent life is a better fit. Here are the key aspects to consider.

Policy length

Term life does not cover you indefinitely. For that reason, it’s popular with young families who expect to increase their financial stability over time. If you are early in your career and the primary income-earner in the household, for example, term life insurance makes sense. The premiums are low enough to allow for a large death benefit — ideally, large enough to cover outstanding debt and ongoing living expenses for your spouse and children.

Later, as you establish yourself financially, you can transition to a more expensive permanent life policy that offers cash-value benefits.

Cash value

Only permanent life policies build cash value that you can access during your lifetime. For most policy types, you can borrow or withdraw those funds without tax implications, as long as you don’t take out more than you paid in. That makes your life insurance substantially more valuable. You can use it to pay your premiums, to cover emergency expenses, or to generate tax-free income in retirement. You could also let your policy lapse and keep the cash value, or you can even sell a policy that has accumulated cash value.

Premium payment flexibility

Term life policies are cheaper, but also more rigid with respect to premium payments. With term life, you pay the stated premium or your coverage lapses. With your permanent life policy, you can use accumulated cash value to pay your premiums. Some permanent life policies — specifically, universal life — give you varying premium options on your first day of coverage.

Death benefit

If you are young and healthy, you’ll get the largest death benefit for the lowest premium on a term policy. Term life, however, gets prohibitively expensive as you get older. Permanent life coverage is intended to stick with you for life, so you have that death benefit no matter how old you are. To protect your permanent life death benefit, choose a whole or universal life policy, pay your premiums, and don’t borrow against your cash value.

Option to sell

Because permanent life insurance builds cash value, it’s an asset — much like a home or car. If you no longer want your permanent life coverage, there are two ways to cash it out. You can let the policy lapse and take a cash-value payment, less any fees, from your insurer. Or you can sell the policy through a life settlement company like Harbor Life Settlements. Of the two strategies, selling usually generates more cash. The policy is usually worth an amount that’s more than the cash value, but less than the death benefit. Once you sell, the premiums are no longer your responsibility and the buyer will receive the death benefit.

Your policy is marketable if you are over age 70 and the face value is at least $50,000. Reputable life settlement companies will price your policy for free and without obligation.

Term life insurance policies can also be sold for cash, but in most cases, you’ll get the most value by converting the term policy to a permanent policy, like whole or universal.

When to Get Life Insurance

Life insurance isn’t a product you purchase for yourself. It’s for the loved ones you leave behind. As financial expert Suze Orman has said, “If there is anyone dependent on your income — parents, children, relatives — you need life insurance.” Here are three scenarios in which life insurance can create security for your family’s future.

You’re Married

When you’re married, it’s not a question of whether to get life insurance — it’s a question of how much you need. At a bare minimum, you should arrange for enough to cover your burial expenses. Other factors to consider are ongoing living expenses without your income, the quality of life you envision for your spouse after you’re gone, any outstanding debts, and the needs of your dependent children.

You Have a Mortgage

Mortgage debt is a major factor in the life insurance equation. Will your family have the means to keep paying the mortgage if you’re not around? And, is that something you want them to worry about? You could research mortgage life policies if you need an affordable solution. But many policyholders will simply structure their permanent or term life benefit to cover the outstanding mortgage debt along with any other obligations.

You Have Children

Having kids dramatically increases the amount of life insurance you’d ideally want. The benefit should be sufficient to ensure the kids don’t get uprooted from their home, school, or neighborhood. Private school tuition might be a factor, along with the future cost of college education.

What Type of Life Insurance Should You Get?

Life insurance is a very personal decision. If cash flow is tight today, a term life policy gives you the most bang for your buck. But as you establish yourself financially, your needs become more complicated and you might want to start considering the cash-value aspects of permanent life. You can access that cash through withdrawals, loans, or selling your policy, which gives you added financial flexibility in your senior years.

The type of permanent life that’s right for you depends on your risk tolerance and whether the death benefit or tax-deferred savings is your primary focus. These policies can be enormously complex and it’s important to make sure you understand all the nuances. Talk with a trusted financial advisor to clarify your needs and choose the most appropriate life insurance for your situation.

Sources

https://www.investopedia.com/terms/t/termlife.asp

https://www.investopedia.com/terms/p/permanentlife.asp

https://www.iii.org/article/what-are-different-types-permanent-life-insurance-policies

https://www.investopedia.com/terms/v/variablelifeinsurancepolicy.asp

https://www.investopedia.com/ask/answers/08/variable-life-insurance.asp

https://www.investopedia.com/terms/v/variableuniversallife.asp

https://www.allstate.com/tr/life-insurance/indexed-universal-life-insurance.aspx

https://www.investopedia.com/terms/g/guaranteed-issue-life-insurance.asp