Whether you’re the buyer or the seller, a life settlement can reshape your finances in short order. Unfortunately, not all investors and policyholders have access to the same level of life settlement opportunity. That’s because the secondary markets for life insurance vary in size and activity level from state to state. In our latest study, the Harbor Life Settlements U.S. Life Settlement Index, we set out to quantify those differences and identify the states that are most and least accommodating to life settlements.

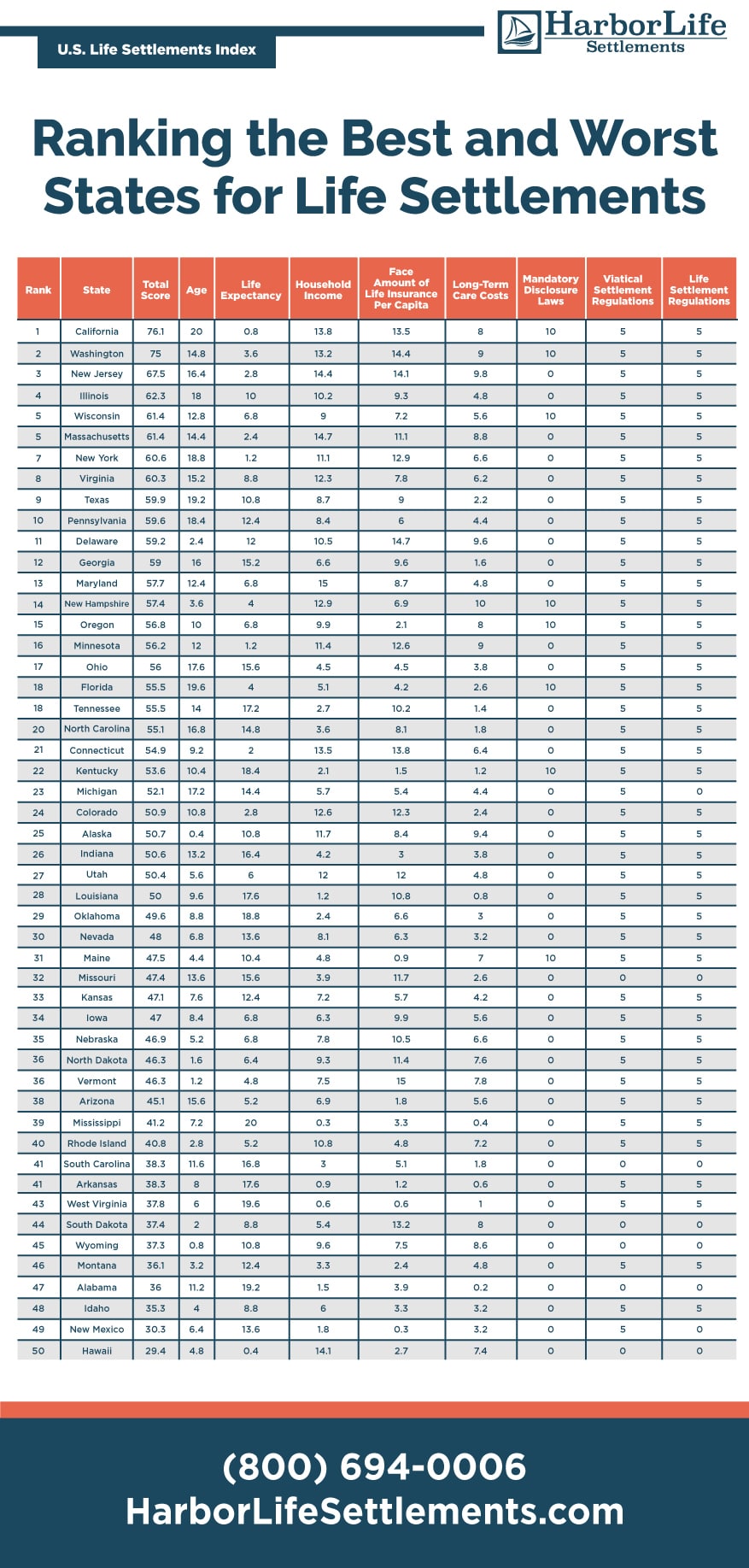

The U.S. Life Settlement Index ranks the 50 states on seven weighted attributes that affect life settlements. These are median household income, average life expectancy, the size of the population aged 75 or older, the median monthly cost of long-term care, the face amount of life insurance per capita, whether the state regulates viatical settlements and life settlements, and whether the state requires life settlement disclosures to policyholders.

Based on those factors, California comes out on top as the state most favorable to the life settlement industry. Behind California are Washington, New Jersey, and Illinois, with Wisconsin and Massachusetts tied for fifth on the index. Hawaii ranks the worst among the 50 states, and New Mexico, Idaho, Alabama, and Montana are also in the bottom five.

The presence of state regulations proved to be an influential factor in the ranking. The six states ranking in the top five spots all have regulations in place for life and viatical settlements, and three have mandatory disclosure requirements.

States that rank poorly generally have low regulatory scores as well as below-average performance across multiple factors, including the face value of life insurance per capita, the size of the senior population, median income, and median cost of long-term care.

Surprisingly, three of the bottom-five states scored well on life expectancy with shorter-than-average lifespans. A shorter average lifespan increases life settlement activity because it makes life insurance more attractive to investors. In those three low-ranking states (Montana, Alabama, and New Mexico), the shorter lifespans weren’t enough to offset other factors.

Ranking the best and worst states for life settlements

California determined the best state for life settlement opportunity

California earns the top spot on the U.S. Life Settlement Index with a score of 76.1. Golden State residents earn a higher-than-average living, with a median income of $80,440. They do carry slightly less life insurance than second-ranked Washington and third-ranked New Jersey, and the median cost of monthly long-term care is also lower. But California still rises to the top of the index on the strength of its life settlement disclosure requirements and the number of state residents aged 75 and older, which is nearly 2.5 million.

California’s massive population of wealthy seniors should drive life settlement activity in the years ahead. While the state’s monthly median long-term care costs of $5,339 are slightly lower vs. Washington and New Jersey, those costs are still about 13% above the national average. To fund those care expenses, many California residents will look to liquidate their life insurance for maximum cash proceeds in a regulated life settlement.

The rest of the best

Washington, New Jersey, and Illinois are just behind California for life settlement opportunity, respectively ranking two through four on the index. Wisconsin and Massachusetts round out the top five with a tie in the fifth-ranking spot. As noted, all of these states do regulate life and viatical settlements. California, Washington, and Wisconsin also require life settlement disclosures to life insurance policyholders.

Among these top-ranking states, only California and Washington are close in cumulative scoring, separated by 1.1 points. There is a 14.7-point difference between top-ranked California and fifth-ranked Illinois and Wisconsin. The lack of mandatory disclosure laws in New Jersey, Illinois, and Massachusetts contributed to that point spread.

Washington has a smaller elderly population relative to New Jersey and California. But the state does have the fifth-highest long-term care costs and the third-highest face amount of life insurance per capita nationwide. The life expectancy in Washington of 80.3 years is on par with New Jersey, but a year shorter than California.

New Jersey residents enjoy the third-highest median household income in the country and the fourth-highest life insurance value per capita. The population of those aged 75 or older is about 642,000 and the average life expectancy is a moderate 80.5 years. The state’s median monthly cost of long-term care ($6,400) is above average, too.

Illinois has the country’s sixth-largest population of residents aged 75 and over, at about 867,000. The Prairie State also gets a boost on the index for its average life expectancy of 79.3 years. While that number is above the national average, it’s the shortest among the states ranked in the top five. Relative to the country as a whole, Illinois also has a higher-than-average household income at $69,187 and life insurance per capita, at $9,447.

Wisconsin and Massachusetts earned the same index score of 61.4, but for different reasons. Massachusetts has the second-highest median household income in the country at $85,843. Despite that high income, residents of the state carry about 30% less life insurance per capita than Vermont, which has the highest rank nationwide on this metric. Massachusetts’ population of seniors aged 75 or older totals about 470,000 and the state’s average life expectancy is relatively long at 80.7 years.

Wisconsin has a significantly lower household income than Massachusetts, as well as a smaller population of seniors aged 75 and older, lower long-term care costs, and less life insurance per capita. But life expectancy in Wisconsin is shorter at 79.6 years, and Wisconsin does require disclosures to life insurance policyholders about life settlements.

The worst states for life settlement opportunity

The five states with the lowest ranking on the U.S. Life Settlement Index are Montana, Alabama, Idaho, New Mexico, and Hawaii. Hawaii is something an outlier, but the other four states share low median income, shorter average lifespans, and lower costs for long-term care. As with the top-ranking states, these five low-ranking states are only separated by fewer than 7 points.

Montana and Alabama have similar insured values and life expectancies, but Montana earns the higher rank for its regulatory structure. The state oversees viatical and life settlements, while Alabama does not. Montana has a smaller elderly population of about 82,000, but fairly high long-term care costs, averaging $7,098 monthly.

Alabama has the lowest median long-term care costs nationwide at $3,432 monthly. The state also has the country’s fifth-lowest median household income of $51,734 and a lower-than-average insured value of $7,477. As noted, Alabama does not regulate viatical or life settlements and does not require any disclosures to policyholders. The main factor keeping Alabama from being dead last in the index is the state’s short life expectancy of 75.5 years.

Idaho does regulate both viatical settlements and life settlements, but the state scores poorly on the two highest-weighted attributes in the index: Idaho’s senior population is small and its average life expectancy is longer than average. As well, Idaho ranks in the bottom half of the country in terms of median household income and face value of life insurance per capita.

New Mexico residents have the lowest amount of life insurance in the country and a below-average median household income. The Land of Enchantment does regulate viatical settlements, but not life settlements. Across all 50 states, Hawaii ranks the lowest on the U.S. Life Settlements Index. Contributing factors include the longest life expectancy of any state, plus the lack of regulations on life or viatical settlements. Hawaiians also have a lower-than-average insured value at $7,106, despite the high median household income of $83,102.

State regulations and disclosure requirements are highly influential in fostering an active secondary market for life insurance. Regulations have a primary function of protecting policyholders, insurers, investors, and brokers. They also legitimize the industry. A regulatory framework confirms to policyholders that selling life insurance is every bit as legal as selling a home or car. As well, mandated disclosures help prevent policyholders from losing tens of thousands of dollars in value because they didn’t know about life settlements or didn’t trust the validity of the transaction.

Notably, the 10 highest-ranking states in the index all regulate viatical and life settlements. Three of the Top 10 also require policyholders to be notified about life settlements before they lapse a policy or sign up for Medicaid.

Why life settlements matter

In 2017, the U.S. Government Accountability Office produced an in-depth analysis of the challenges facing the U.S. retirement system. The report concludes that many U.S. households are underfunded for retirement, noting that retirees spend large and growing shares of their income on health-care costs. Since that time, the COVID-19 pandemic has substantially eroded the financial security of many retirees and prospective retirees.

Life settlements can play a primary role in solving the American retirement crisis, by unlocking wealth built from years of life insurance premium payments. Too many Americans today are lapsing or surrendering their life insurance, without realizing they’re giving up a valuable asset for less than it’s worth. That’s why it’s critical to educate Americans about life settlements and push for expanded legislation and disclosure requirements nationwide.

Methodology

To calculate the results of our U.S. Life Settlement Index, Harbor Life Settlements pulled data points from eight publicly available sources and focused on data from 2019. We scored the states on each attribute based on relative performance, and then weighted those scores as follows:

- Age (20%)

- Life Expectancy (20%)

- Face Amount of Life Insurance Per Capita (15%)

- Median Household Income (15%)

- Median Monthly Long-term Care Costs (10%)

- Mandatory Disclosure Laws (10%)

- Viatical Settlement Regulations (5%)

- Life Settlement Regulations (5%)

Citations:

https://www.census.gov/library/visualizations/interactive/2019-median-household-income.html

https://www.cdc.gov/nchs/data-visualization/life-expectancy/

https://www.census.gov/data/tables/time-series/demo/popest/2010s-state-detail.html

https://skloff.com/cost-of-long-term-care-by-state-2019/

https://stacker.com/stories/3152/states-spending-most-life-insurance-policies

https://blog.lisa.org/member/life-settlement-regulation-by-state-map