If you’re looking for an insurance policy or trying to estimate how much you’ll pay for a lifetime of coverage, check out this guide to learn about the cost of life insurance by age for term and whole life policies.

How Life Insurance Rates Are Calculated

Life insurance rates are based on several factors, but the general rule is that premiums correlate with your age and health. Younger, healthier individuals will have the lowest premiums because they’re considered less likely to pass away (resulting in a death benefit payout) than older individuals or those with chronic or terminal illnesses. Smoking also has a big impact on your rates, and that alone can sometimes double or triple the amount you’ll pay.

Insurance carriers will have unique processes and differences in how factors are weighed, but here’s what most insurers look at when determining a person’s life insurance rate:

- Age: Insurance premiums tend to go up with age, because life expectancy goes down and insurance carriers are more likely to have to pay out a death benefit.

- Health: Healthier individuals have lower premiums because they have a longer life expectancy, so insurance companies will look at your health status including pre-existing conditions, height, and weight to get an idea of how healthy you are. You may also be required to get a medical exam to obtain coverage.

- Gender: Women have longer life expectancies than men (80.5 for women, 75.1 for men), so they usually have cheaper premiums.

- Smoking Status: Smokers have a higher risk of developing health issues like respiratory diseases, so they usually have higher life insurance premiums.

- Family Medical History: Even if you’re healthy, your insurer may ask for information about your family’s medical history to determine if you have a higher risk of developing conditions later in life.

- Lifestyle: Your lifestyle may put you at a higher risk of developing health issues or dying earlier than your estimated life expectancy. Having a high-risk job like being a police officer or participating in risky activities like mountain climbing can increase your premiums.

- Policy Type: Term life insurance tends to be less expensive than whole life insurance because term policies don’t build cash value and only provide coverage for a set period of time. For example, a 10 year term policy purchased when you’re 20 will be cheaper than a whole life policy purchased at the same time, because the term policy is basing premiums on your risk when you’re young while the whole life policy has to base premiums on your projected life expectancy.

- Policy Size: The size of the death benefit payout will also influence how much life insurance costs, as a higher payout will require more expensive premiums for both term and whole life policies.

- Insurance Riders: Riders are optional provisions offered by insurers that amend the terms of the policy to add benefits for a higher cost. Common riders include accelerated death benefit riders, family income riders, and long-term care riders among others. Selecting one or more riders will add to the cost of life insurance premiums.

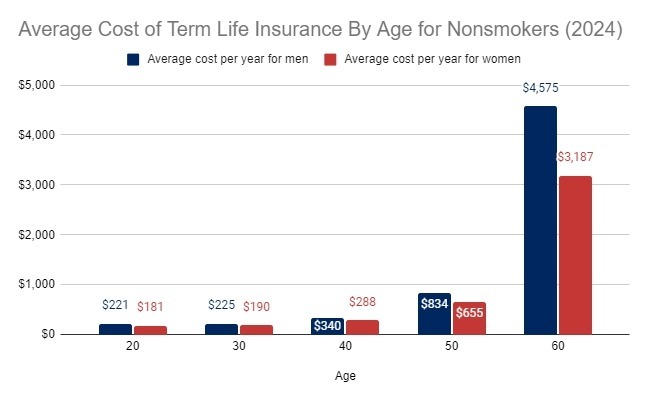

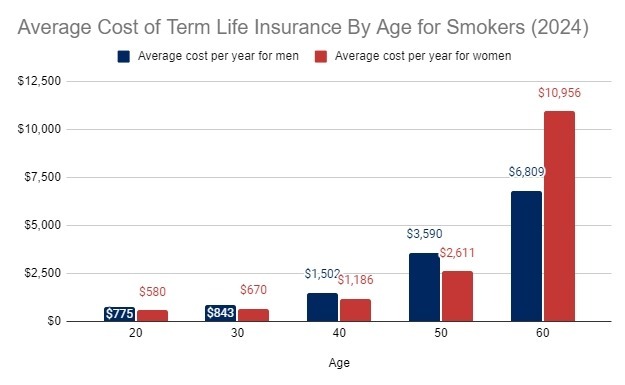

Term Life Insurance Rates By Age Chart

While figures for 2025 have yet to be released at the time of publishing, according to NerdWallet data from February 2024, these are the average annual rates of a $500,000 20-year term life insurance policy for preferred applicants in good health. The rates for nonsmoking men range from $221 at age 20 to $4,575 at age 60, while the rates for smoking men range from $775 at age 20 to $6,809 at age 60. For nonsmoking women, rates range from $181 at age 20 to $3,187 at age 60. Rates for smoking women start at $580 at age 20 and go up to $10,956 at age 60.

As the charts above indicate, term life insurance is much cheaper for younger individuals and the cost increases dramatically with age. The most substantial increase comes when you turn 60, as you can expect your premiums to increase anywhere from 89.7-448.6%. For example, the average annual cost of a term policy for a male nonsmoker is $834 at age 50, but jumps to $4,575 by age 60. A nonsmoking woman sees a similar jump, from $655 at age 50 to $3,187 at age 60. Of course, smoking can impact your premiums even from a young age, as smoking men and women can expect to pay two to three times as much for coverage than their nonsmoking counterparts.

Term policies provide coverage for a set period of time, so rates tend to be relatively cheap when you’re young but dramatically increase as you get older. They can be a cost effective option for young, healthy individuals compared to whole life insurance.

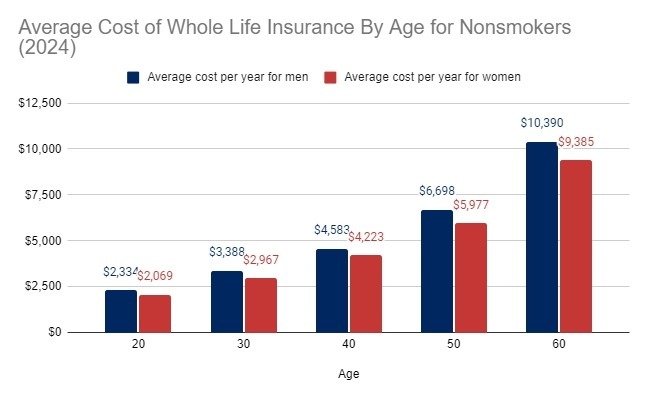

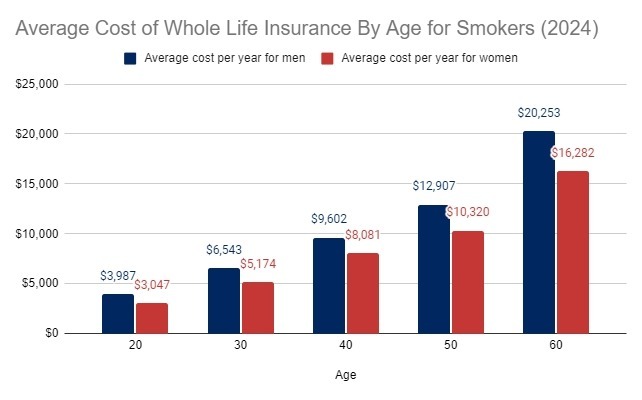

Whole Life Insurance Rates By Age Chart

According to NerdWallet data from February 2024, these are the average annual rates of a $500,000 whole life insurance policy for preferred applicants in good health. The rates for nonsmoking men range from $2,334 at age 20 to $10,390 at age 60, while the rates for smoking men range from $3,987 at age 20 to $20,253 at age 60. For nonsmoking women, rates range from $2,069 at age 20 to $9,385 at age 60. Rates for smoking women start at $3,047 at age 20 and go up to $26,282 at age 60.

Whole life insurance premiums are set when you purchase the policy and will remain the same as long as you keep the policy in force. So if you buy a policy when you’re 30, you’ll continue paying that premium for the rest of your life. This means you’ll likely pay higher premiums initially while you’re young, but your coverage in your senior years will be much cheaper than what you’d pay for a term or starting a new whole life policy. You can see this reflected in the charts above, as the increase in premiums is much more linear compared to how term premiums increase by age.

For example, the cost of a whole life policy for nonsmoking men at the age of 50 is $6,698 and increases to $10,390 at age 60. It’s still a notably increase at a rate of 55.1%, but it’s far less than the 448.6% price increase we saw for term policies applied to the same age group.

How Much Life Insurance Do You Need?

The primary purpose of life insurance is to provide a financial safety net for loved ones after a policyholder dies, which means having enough coverage to pay off any debts and provide replacement income for dependents. While it’s best to work with a financial advisor to get an accurate figure based on your assets and liabilities, an easy way to estimate how much life insurance you need is by multiplying your household income by ten. So if you and your partner have a combined annual income of $140,000 — you should have at least $1.4 million in life insurance coverage. If you have children, it’s also a good idea to add an extra $100,000 per child to the final figure.

Ways to Lower Life Insurance Rates

You may be able to lower your life insurance rates through activities that help you maintain a healthy lifestyle:

- Get coverage early: The cost of life insurance increases dramatically as you get older, so getting coverage while you’re young can help you get lower premiums. Young doesn’t have to mean 20 or 30. Getting a term policy at 40 or 50 instead of 60 can save you thousands of dollars a year.

- Avoid smoking: Due to the negative health effects of smoking, insurers will increase your rates if you’re a smoker. Avoiding or quitting smoking can cut your life insurance premiums in half or even a third of what you’d pay as a smoker.

- Maintain a healthy weight: Keeping a healthy weight reduces your health risk, as being overweight is linked to heart disease and higher mortality rates. As a result, insurers may charge less if you can maintain a healthy weight.

- Minimize risky activities: Insurers will charge more if your lifestyle includes activities that can cause risk for your health like race car driving, rock climbing, and sky diving. Minimizing or replacing these hobbies with less risky alternatives can lower your life insurance rates.

If you’re up for renewal and your life insurance rates are projected to be unaffordable even after doing things to reduce their cost, you’ll need to weigh your options. You can consider lapsing coverage, surrendering it, or selling the policy through a life insurance buyout. Depending on your policy type and cash value, you may be able to recoup some of the money you’ve paid in over the years.