There are a lot of unknown factors that make planning for senior living difficult, such as if you’ll need care and for how long. However, the cost is one of the hardest things to account for given how expensive senior care is today and data that suggests it will continue going up.

The current national median cost of an assisted living facility or a nursing home ranges from $5,350 to $9,733 per month, and those costs have gone up each year since 2010.

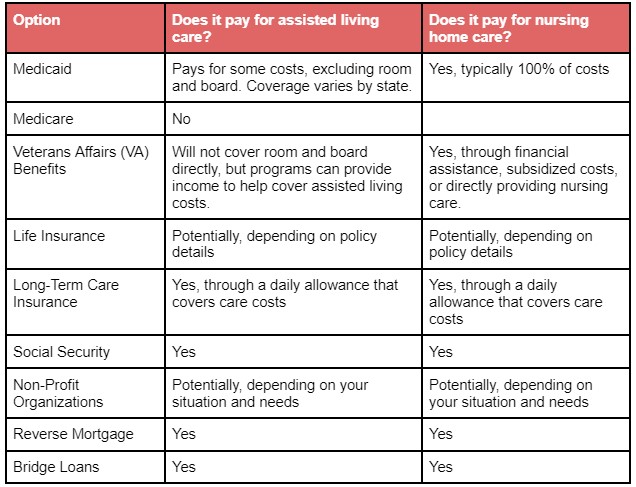

While it can be hard to comprehend covering these costs with limited or no money, there are several options available for seniors such as Medicaid, veterans benefits, and insurance among others. These resources can significantly reduce, or even fully cover the cost of senior living expenses.

In this guide, we’ll share all the ways you can pay for assisted living or nursing home care without any money.

Key Takeaways

- Senior care through an assisted living facility or nursing home can be expensive, but there are several options to help cover costs

- Options to pay for care without money include government programs, insurance, non-profit organizations, and private loans

- If an assisted living facility or nursing home is still too expensive, you may want to consider cheaper options like homemaker services, a home health aid, or adult day care

Ways to pay for senior living without money

For a quick overview of options to pay for senior living with no money, check out the table below:

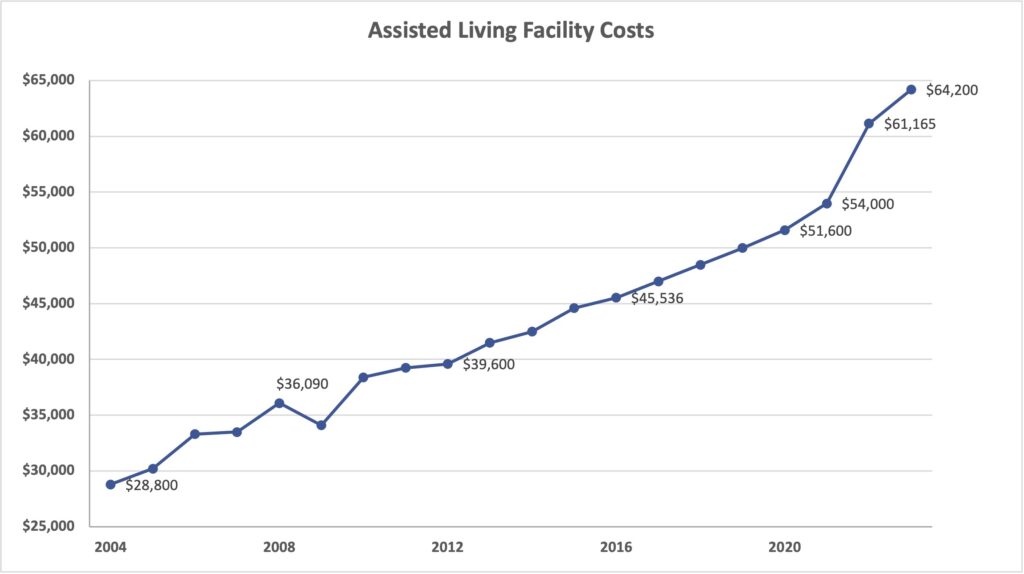

Assisted living facilities are intended for seniors who need support with activities of daily living (ADLs), but don’t require 24/7 supervision or extensive medical care that’s available at a nursing home. According to Genworth’s 2023 Cost of Care Survey, the national median cost for assisted living care services is $5,350 or $64,200 per year. These costs have increased by 24.4% since 2020, and have gone up each year since 2010 which suggests they’ll continue rising.

If you require assisted living care but don’t have the money to afford it, these options can help you cover the costs. Medicare is not listed because it doesn’t cover assisted living, only nursing home care. Here’s some more information about these options and how they pay for assisted living costs.

Medicaid Coverage

Medicaid can pay for assisted living costs, but what’s covered depends on your state’s regulations. This is because Medicaid is jointly funded by the federal and state governments, and each state sets their own policies about what’s covered.

Most states offer Medicaid coverage to help with assisted living costs, and you can typically use Medicaid waivers to pay for things like:

- Long-term care in an assisted living community

- Inpatient and outpatient hospital services

- Prescription drugs

- Physical, occupational, and speech therapy

- Eyeglasses and hearing aids

- Personal care services

- Medication management

- Transportation

- Housekeeping services

However, Medicaid does not cover room and board costs associated with assisted living facilities. Furthermore, Alabama, Louisiana, Pennsylvania, Virginia, and New York offer little or no coverage for these costs. You can learn about the waivers and benefits available for your state on the Medicaid.gov website.

Veterans Affairs (VA) Benefits

If you’re a veteran or spouse of a veteran, you may be eligible for Veterans Affairs (VA) benefits that can help cover assisted living costs. VA benefits don’t directly pay for costs like room and board, but veterans can apply for Aid and Attendance benefits which offer up to $2,727 per month and can be used to pay for assisted living costs. The amount you receive varies based on your marital status and dependents, and to be eligible you or your spouse must have served in the military for at least 90 days during a conflict and you must demonstrate medical and financial need.

If you don’t qualify for Aid and Attendance benefits, you may also be able to qualify for a VA Pension, Survivors Pension, or VA Disability Compensation that can provide monthly payments to help cover assisted living costs.

Long-Term Care Insurance

Life Insurance

- Living Benefits: Some policies feature living benefits that allow you to access a portion of the death benefit while you’re still alive and leave the rest for beneficiaries after you pass away.

- Surrender: Permanent life insurance policies with cash value can be surrendered back to the insurer for a payout.

- Loan: You may be able to borrow money from your policy in the form of a loan, which is generally lower than what you’d get from the bank.

- 1035 Exchange: A 1035 exchange may allow you to convert the cash value of a life insurance policy into long-term care insurance to pay for assisted living expenses.

- Sell the Policy: You may be able to sell your life insurance policy through a transaction known as a life settlement. The amount will be greater than the surrender value, but less than the death benefit.

Social Security

Social Security is the core part of many seniors’ retirement plans, as the benefits provide a continuous income stream which can be essential if you’ve run out of money in retirement. As of February 2024, 97% of older adults (ages 60 to 89) currently or will receive Social Security and the average Social Security benefit was about $1,862 per month, or $22,344 per year. The monthly amount can also be increased by up to 30% by delaying benefits until your full retirement age, and Supplemental Security Income (SSI) can provide additional benefits for individuals with low income. In 2024, the monthly SSI benefit is $943 for an eligible individual and $1,415 for a couple.

So while Social Security won’t completely cover assisted living services, the money it provides can help significantly with the recurring costs.

Non-Profit Organizations

If you have no money and other options don’t cover assisted living costs, you may be able to close the gap through assistance from a non-profit organization. There are several groups that provide financial assistance, care services, and resources for seniors who require assisted living. Here are a few non-profit organizations to look into:

- Salvation Army: The Salvation Army provides direct financial assistance to seniors including money to help pay for assisted living, rent, and utilities.

- AARP Foundation: The AARP Foundation doesn’t directly fund assisted living costs, but offers resources and guidance to help find affordable housing and care.

- National Council On Aging: The NCOA doesn’t offer financial assistance, but they do provide resources and tools to help seniors and caregivers plan a healthy life.

- Family Caregiver Alliance: The FCA provides grants and resources to caregivers to help provide elder care.

- Alzheimer’s Foundation of America: The AFA provides grants to local member organizations to provide support, including care for individuals with Alzheimer’s.

- Meals on Wheels America: Meals on Wheels America doesn’t pay for assisted living costs, but provides nutritious meals to seniors across the country which can help them spend less on food to pay for care.

It’s also a good idea to check for any local foundations or groups that serve your community, as they can connect you with groups that may not be well-known.

Reverse Mortgage

If you own a home but don’t want to sell or rent it, you can use a reverse mortgage to borrow against the home’s value. A reverse mortgage is a loan that builds interest and comes with fees, but you’re only required to repay it when you sell the home, permanently move, or pass away. The money you get from a reverse mortgage can be paid in a lump sum, monthly, or on a schedule you define and the amounts you want.

It can be a good option if you have a spouse and one of you needs to stay in the home while the other goes to an assisted living facility. To be eligible, all homeowners must be at least 62 years old and at least one owner must use the home as their primary residence.

Bridge Loans

If you don’t have any money right now but the situation is temporary, a bridge loan can be a short-term solution to pay for assisted living costs. Bridge loans are short-term loans that are meant to “bridge the gap” until a person has access to permanent financing.

They’re commonly used to help with the transition to assisted living facilities, as the senior may need to pay for care while they wait to sell their house, liquidate investments, or allow time for insurance benefits to pay out. Just be aware that interest rates are higher than you’d get for a traditional loan, so make sure you’ll have a way to repay these costs in the near future.

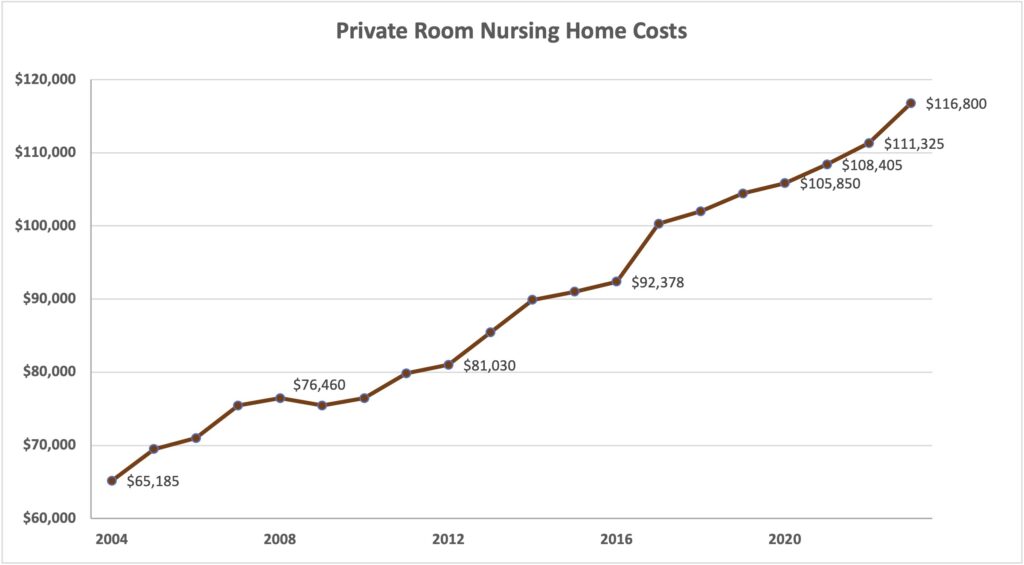

Nursing homes are more expensive than assisted living facilities because they offer 24/7 supervision and additional medical services for seniors with more extensive needs. In Genworth’s 2023 Cost of Care Survey, they found the national median cost for a nursing home was $8,669 per month for a semi-private room or $9,733 for a private room, which adds up to $104,028 and $116,796 each year respectively. Much like assisted living facility costs, the long-term data about private room costs for a nursing home has gone up over time which suggests nursing home costs will continue to rise.

In general, the options for paying for assisted living facilities also apply to living in a nursing home. However, there are a few differences in some of the options available. Here are some details about the specific options for paying for a nursing home without money.

Medicaid

Just as Medicaid can pay for assisted living, it can also help cover costs for seniors who need nursing home care. In fact, Medicaid was the primary payer for 59% of nursing facility residents and 62% of nursing home residents used Medicaid to pay for care.

Best of all, is that Medicaid typically pays for 100% of nursing home costs which means it can provide care even if you have no money. Of course, extra amenities like a private room may not be included in what’s covered and would have to be paid for through other means like family member support.

Medicare

While Medicare won’t cover assisted living, it will cover short-term stays in a nursing home if you require special care after a hospitalization of at least three days. Special care may include physical therapy, speech therapy, occupational therapy, and other rehab services.

If you qualify for Medicare nursing home coverage, it will cover 100% of the cost for the first 20 days and then you’ll need to pay a copay up to $200 per day for days 21 to 100. If you need to stay in a nursing home for more than 100 days, you’ll have to cover the full additional cost without Medicare.

Veteran’s Benefits

The VA offers three options to get nursing home care for eligible veterans. Veterans can receive nursing care in a community living center, which is a residential facility that’s designed to feel like a home. Alternatively, they can get nursing home care paid for or at a lower cost through a veteran-specific nursing home operated by the VA or a nursing home that contracts with the VA. Qualifying for these benefits depends on your service-connected disability and income. You can contact your VA social worker or learn more about the benefits they offer for nursing home care on their website.

If you run out of money while living in a nursing home, you can file a hardship waiver with your state’s Department of Health and Human Services. The waiver should explain how moving out of the nursing home would endanger your health.

Hardship waivers don’t apply for seniors living in an assisted living facility, but you can turn to a local Area Agency on Aging (AAA) to seek assistance remaining in your home. You can also try negotiating with the assisted living facility to see if they can lower your living expenses.

Assisted living facilities and nursing homes are some of the most expensive forms of senior care, but you may be able to choose a cheaper option if you don’t require extensive care. Here are some more affordable care options to consider.

- Homemaker Services: Homemaker services can help seniors who need assistance with non-medical tasks such as housekeeping, meal preparation, and transportation. According to Genworth, the national median cost is $30 per hour, though you may not need to have someone in the home full-time like you would for other options.

- Home Health Aid: A home health aid performs the same duties as a homemaker, but also has additional medical training to assist with activities of daily living. According to Genworth, the national median cost is $33 per hour, though this might be closer to assisted living costs if you need 24/7 care.

- Adult Day Care: Adult day care offers out-of-home supervision for seniors who can’t be left alone. Some facilities focus on social services, while others may offer medical supervision and more extensive care options. According to Genworth, the national median cost is $95 per day, which is significantly cheaper than assisted living facilities or nursing homes even if you require year-round care.

If you’re out of money or concerned that you won’t have enough funds to pay for care, we recommend talking with a financial advisor to learn about your options. If you have a life insurance policy, we can determine its value to see if you’d be interested in selling it through a life settlement. Use our life settlement calculator for a free estimate or contact us to discuss your options.

Written by:

Written by: Edited by:

Edited by: Reviewed by:

Reviewed by: