Your senior years are often referred to as your “golden years” because they’re supposed to represent the time in your life where you can relax after a lifetime of work. However, rising costs associated with inflation can put financial strain on seniors’ finances. Without proper planning, seniors may find their expenses are greater than their income. Over time, this can even lead to seniors burning through their retirement savings with few options left.

Whether you’ve just retired, been away from work for years, or are continuing to work in any capacity — we’ve created this guide and free template specifically for seniors who want to better manage their finances.

Why do seniors need a budget?

Budgets are recommended anyone, but they’re especially important for seniors who’re living on a mix of savings, investments, and potentially limited income from government benefit programs like social security. Unlike younger adults who may have access to a continuous stream of high income from their job, retired senior who run through all of their money may find it difficult to recover without selling assets like a home or life insurance policy.

We found that 44% of retirees struggle to afford basic living expenses, and 48% of retirees believe they’ll outlive their savings. To prevent financial struggles, it’s important for seniors to use a budget that balances their income and expenses as much as possible.

How to use our senior budget template

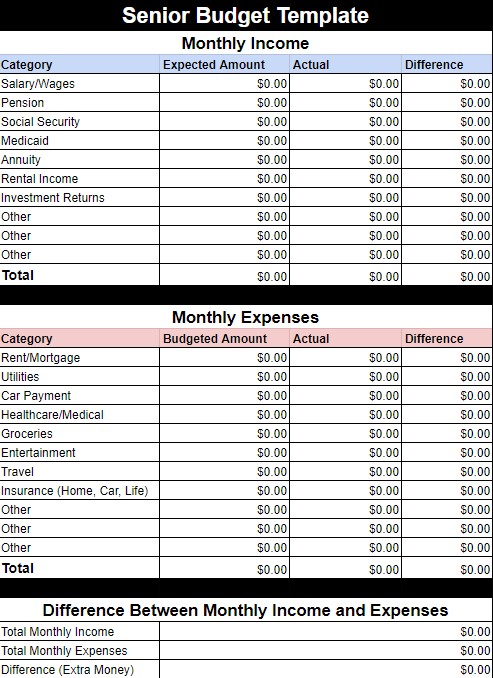

Our budget template is easy to use, simply make a copy of the digital sheet or print it out and fill it in with information about your income and expenses. The template is broken down into two categories, read below for more information about each:

- Monthly Income: Your monthly income represents the amount of money you have coming in each month, which can be broken down into fixed and variable types. Fixed income is the total amount of money you get from fixed sources like a pension, annuity, social security, or Medicaid. The amount of money you get from these sources should be the same each month. Variable income may be different month-to-month, and some months you may not get it at all. For example, dividends you receive from investments can vary each month based on the performance of those investments. When creating your budget, we recommend estimating the amount you can expect from fixed and variable sources each month. You’ll update the template with actual information later and can adjust spending if needed, but estimating income will help you know how much you’ll have to spend on expenses.

- Monthly Expenses: Expenses can also be divided into fixed and variable categories. Fixed expenses are costs that must be paid each month and will be the same each time. For example, a mortgage, car payment, and insurance premiums are all fixed expenses. On the other hand, variable expenses may change from month-to-month. For example, the amount you spend on groceries, eating out, gas, and entertainment will likely be different each month. To prevent spending from getting out of control in any of these variable sub-categories, we recommend setting a figure for how much you want to spend on each and not going over that amount. This system is commonly known as the envelope system because you can think about it like putting money into an envelope labeled with the appropriate category, and once it’s gone, you’d have nothing left to spend for the month.

What to do if your expenses exceed your income

If your monthly expenses are more than your monthly income after filling out the spreadsheet, it means you’re running at a deficit. It’s fine if this happens on occasion, such as having unusually high expenses after traveling or a major purchase like a car. However, this is a problem if your expenses are consistently more than your income. Over time, this will mean you’ll have to burn through your savings, go into debt, or sell assets.

Since your savings will likely be your first option to pay for the difference, you should take your savings and divide it by the deficit to see how many months it would last. For example, if you have $100,000 in savings and the monthly deficit between income and expenses is $1,000, you’d divide 100,000/1,000=100 to determine that your savings would last 100 months, which is a little over 8 years.

Of course, this doesn’t take into account that your expenses will likely go up over time in correlation with inflation. It’s also not a good idea to use all of this money because you may need it for an emergency, and having nothing left could put you in a tough financial spot.

If you are in a difficult situation or took one look at your budget and realized you need to cut back on expenses, one area to look at is your life insurance policy. Life insurance premiums can be very expensive for seniors, so it might be better to get rid of your policy and put all the money you’d pay for it towards your savings. However, you should make sure to get rid of your policy through the option that will get you the most money. Cancelling your policy outright might mean you don’t get anything back, but you might be able to surrender it and get a small payout from your insurance company. The best option though, would be selling it to a third party, which can give you up to 60% of the death benefit amount in a lump-sum cash payment. If you’re interested in this option, get a free estimate on the value of your policy from Harbor Life Settlements today!