Can seniors over 70 get life insurance? The short answer is yes. The life insurance options for the elderly aren’t as plentiful as they are for the younger crowd, but seniors can secure a death benefit even after age 70.

How does senior life insurance work?

It would be fabulous if you could pay a few thousand dollars in life insurance premiums to secure a six-figure death benefit. But as you might guess, insurance carriers are too smart for that deal. That’s why life insurance for the elderly is something of a specialty. Insurers aren’t in the business of paying out more in death benefits than they collect in premiums. And since a senior aged 70 or more is highly likely to pass away within the next 30 years, the insurance has to be structured differently — so that it works for insurer and insured alike.

This will not surprise you, but life insurance for seniors will be more expensive than coverage for a younger insured. Fortunately, there are affordable options available that can meet different needs. These include guaranteed issue whole life insurance, simplified issue life insurance, term life insurance, and guaranteed universal life insurance. Here’s a closer look at each.

Guaranteed issue whole life insurance for seniors (GIWL)

GIWL is available to seniors up to age 85 and is issued without a medical exam or health questionnaire. The “guarantee” is that applicants are automatically qualified; assuming the insurer can verify the senior’s identity, coverage will not be denied. GIWL is a type of permanent insurance, meaning it remains in force as long as the insured pays the premiums.

For a senior who’s been denied life insurance previously due to age or health history, GIWL may sound too good to be true. There are two significant trade-offs to that guarantee, however: The death benefit is limited in size and it’s only payable after a waiting period. Most GIWL insurers cap the death benefit at $25,000, but some go as high as $40,000. The waiting period, known as a graded death benefit, is usually two years. If the insured dies of natural causes in that first two years, the death benefit will not be paid. Instead, the beneficiary will receive a refund of premiums paid on that policy. Some insurers will add 10% or 20% to the amount returned and others will not.

Often, the waiting period will be waived if the insured’s death is an accident. After the waiting period ends, the full death benefit is payable.

GIWL has several nicknames. You might see it called guaranteed life insurance, guaranteed burial insurance, guaranteed final expense insurance, no questions life insurance, or some other combination of those words. Rest assured, these phrases all describe the same thing: Life insurance with a graded death benefit that automatically qualifies applicants without a medical exam.

Simplified issue life insurance for seniors

Simplified issue life insurance is another option for seniors up to age 85. No medical exam is required here, either, though the applicant will need to answer up to 20 health questions. The insurer does have the right to deny coverage. An elderly insured who lives in a long-term care facility, has been declared terminally ill, or has been diagnosed with AIDS or HIV won’t qualify for simplified issue life insurance. As well, the senior applicant who smokes will either be denied coverage or quoted very high premiums.

Lying on the health questionnaire isn’t a viable strategy, either. As part of the application process, the insurer will look up the applicant’s history in medical databases to validate the responses provided to those health questions.

Simplified issue insurance for the elderly is available in coverage amounts up to $100,000, though $20,000 to $50,000 is more typical. Most of the time, there is no waiting period, but some insurers may impose one. One significant difference from GIWL is that simplified issue insurance is not permanent coverage and will expire at the end of the term. Most seniors will not be able to get terms longer than 15 years.

Guaranteed universal life for seniors (GUL)

A GUL policy provides coverage up to a certain age, for a fixed annual premium. The coverage does expire at the stated age, but some insurers will issue GUL coverage up to age 121. That means seniors can structure the coverage to last as long as they do. The application process will involve a health questionnaire and medical exam, and insurers can deny the coverage. But the applicant who can pass the medical exam has access to much higher death benefits, up to $500,000.

Because of the large death benefits available, fixed premiums, and age-based expiration, GUL is a very attractive life insurance option for healthy seniors over age 70.

Term life insurance for seniors

Term life coverage is the most cost-effective choice for seniors, delivering the highest death benefit for the lowest price. As with GUL, term life policies for seniors are available with face amounts of up to $500,000. A medical exam is required. Seniors over the age of 70 can usually qualify for coverage periods of 10 or 15 years, max. The premium remains the same during the period of coverage and the death benefit is guaranteed.

While term life is less expensive than GUL coverage, there is the risk that the insured will outlive the term. Policy renewal for a shorter term after expiration may be an option, but the annual premium will be much higher.

What about cash value?

Several types of life insurance have an investment component that builds value over time, known as cash value. Cash value is not a big factor in policies for the elderly, mainly because it takes decades to accumulate to a sizeable amount. It also adds expense to the policy, because the premiums have to cover the cost of the insurance plus the money that funds the cash value account. And because seniors already pay higher premiums, it makes less sense to absorb the extra expense of cash value.

Even so, cash value is interesting because it gives insureds access to benefits during their lifetime. Of the four types of senior life insurance we’ve covered, only GIWL has some type of so-called “living benefit.” The policy accumulates cash value that the policyowner can later borrow against. Some GIWL policies also offer access to cash when the insured is terminally ill.

Simplified issue life insurance, GUL, and term life coverage do not accumulate cash value.

What type of life insurance is best for seniors over 70?

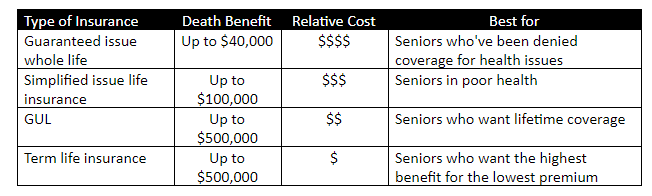

There’s no one answer to which life insurance is best for seniors over the age of 70. It really depends on the senior’s health status, the budget available to pay premiums, and the desired death benefit. Unfortunately, seniors in very poor health cannot secure a large, guaranteed death benefit. Those individuals are limited to lower death benefits, designed to cover final expenses or pay off minor debts.

Seniors in their 70s who are in good health have more options, assuming they can pass a medical exam without red flags. Those applicants have access to much higher death benefits under a GUL policy or term coverage. GUL is more expensive than term but can be structured to last longer. A 75-year-old senior might qualify for a GUL policy with coverage until age 105, for example. But an equivalent term policy would need a 30-year term — which is not something an insurer would offer to a 75-year-old.

The table below summarizes the four main types of life insurance for seniors in terms of death benefit and relative cost.

Senior life insurance premiums

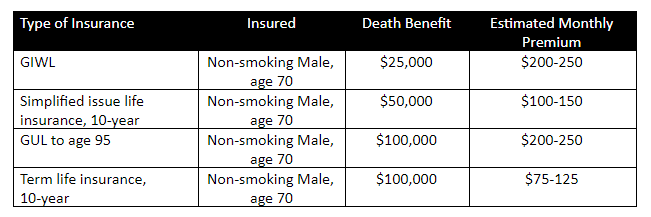

Premiums for senior life insurance can vary dramatically based on the coverage type, the death benefit, and the term. The table below shows sample rates by type of coverage. Your rates may be quite different, depending on your age, gender, and health history.

You can see that GIWL coverage is the most expensive, given the size of the death benefit. Also note that simplified issue and term life coverages are only in force until the insured reaches age 80, while the GIWL is permanent coverage and the GUL extends coverage to age 95.

Senior life insurance companies

If you’re ready to shop for senior life insurance, plan on collecting several quotes. As with any type of insurance, premiums can range widely from one insurer to another — so it definitely pays to shop around. Keep your search focused on large, well-known insurers, as well. They’re more likely to have deep experience in elderly life insurance, plus varied coverage options and strong customer service.

The table below shows some of the companies that specialize in the different types of elderly life insurance.

Type of Insurance | Best Insurance Companies |

| GIWL | AAA AIG Gerber Life Mutual of Omaha New York Life |

| Simplified issue life insurance | AAA American Family Mutual Insurance MetLife Prudential |

| GUL | AIG Protective Mass Mutual Mutual of Omaha New York Life |

| Term life insurance | AIG Mutual of Omaha New York Life State Farm

|

Low premiums vs. guaranteed coverage

Even unhealthy seniors over age 70 can get limited amounts of life insurance coverage with a GIWL or simplified issue policy. Those who are healthy have more options and should weigh lower premiums against more certainty in coverage. A 10-year term life policy will be the most affordable, but it does come with the risk that the policy expires before the death benefit is paid. For that reason, GUL is often the best choice for a healthy senior over age 70 — because the death benefit can be secured to an age that’s beyond the insured’s projected lifespan. In that way, the insured can be confident that the beneficiary will receive that payout.