DISCLAIMER: The information in this blog post is purely based on opinion. For financial guidance or investing assistance, Harbor Life Settlements recommends consulting with a professional advisor.

A survey conducted in 2022 found that 55% of Americans are behind on retirement savings, and nearly one-third (32%) of working age Americans have no retirement savings.

Retirement income planning can be intimidating at first glance, as it requires looking at your current finances and long-term planning about your goals for the future. To help you start, we’ve simplified the process into six easy-to-follow steps that you can do at any stage, whether you’re just starting to work or nearing retirement.

Follow these step-by-step instructions to create a retirement income plan that includes how much money you’ll need and strategies to help you achieve this goal by the time you want to stop working.

Step 1: Decide when you want to retire

First and foremost, think about when you’d like to stop working completely. The national average age of retirement is 62, with 64% of Americans choosing to retire between the ages of 55 and 65. However, retiring as soon as possible means you’ll get reduced social security benefits. By waiting until your full retirement age, you’ll be able to claim the maximum benefit amount from the government.

Retiring doesn’t have to mean completely stopping work, you could consider working reduced hours for a few years until you reach the full retirement age. By doing this, you can ease into retirement with a continuous income stream and get the max benefits when you decide to fully stop working.

The important thing is for you to set a firm goal of when you want to stop working completely. Set a benchmark so you can adequately plan for retirement in advance, which will help you set achievable goals and potentially get ahead so you can retire early.

A lot of people set a general goal of retiring by age 65, but think about your unique situation. If you have a significant other, do you want to retire at the same time? Do you have kids or grandchildren you want to spend time with before they graduate high school or college and potentially relocate? These are just a few of the things you should think about when deciding when you’d like to retire. You can always adjust later as needed (in fact, 60% of retirees said they actually retired sooner than they planned), but it’s important to have a goal.

Step 2: Estimate retirement living expenses

Arguably the most important part of retirement income planning is estimating how much you’ll spend on an annual basis after you decide to stop working.

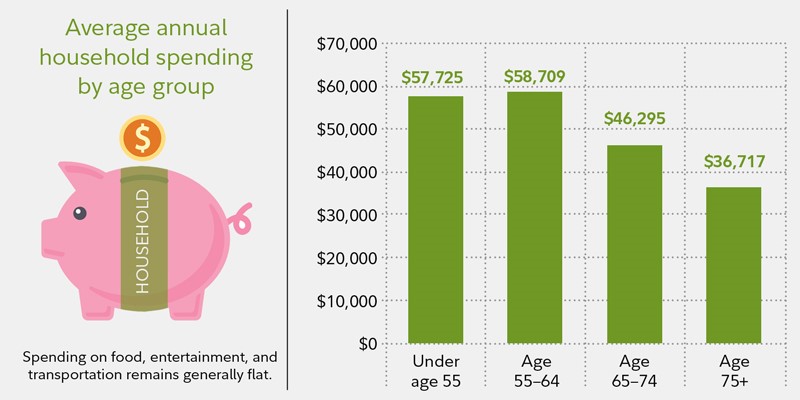

Research suggests that spending tends to go up when individuals turn 55 and increases slightly until the person reaches 65. At this point, spending tends to change as you’ll likely spend less on housing because you’ve paid off your mortgage, but can expect to pay more for healthcare costs due to higher insurance premiums and others costs.

(Source: Fidelity)

There are a lot of retirement calculators out there, but our personal favorite is the SmartAsset retirement calculator. None of the calculators you’ll find will cover absolutely everything since every situation is unique, but this is a good start.

We’ve also included monthly expense data for “older homes” (defined as those run by someone 65 or older) from the Bureau of Labor Statistics. On average, these homes spend $45,756 per year (or about $3,800 a month). For reference, here’s a breakdown by category of monthly expenses for homes run by someone 65 or older:

- Housing: $1,322

- Transportation: $567

- Healthcare: $499

- Food: $483

- Personal Insurance/Pensions: $237

- Cash Contributions: $202

- Entertainment: $197

While these averages provide a base estimate, it’s important to remember that expenses will change as you age (especially with regards to healthcare/insurance costs). You’ll also need to account for taxes you’ll pay during retirement, which may vary based on the assets you own and where you live. The general rule of retirement income planning is that you should aim to replace at least 70% of your income to maintain the same standard of living. However, you should also look for ways to reduce unnecessary costs like a larger home than you need or expensive life insurance premiums.

Step 3: Create a retirement investing strategy

Most retirement calculators will tell you how much money you need to save each month, but it’s important to remember that there is a key difference between saving and investing. Saving money simply means putting a small percentage of your paycheck away each month, but savings should really only be used for short-term goals and as a security blanket in the case of a financial emergency. For retirement, you’ll want to invest your money so that it can grow over time.

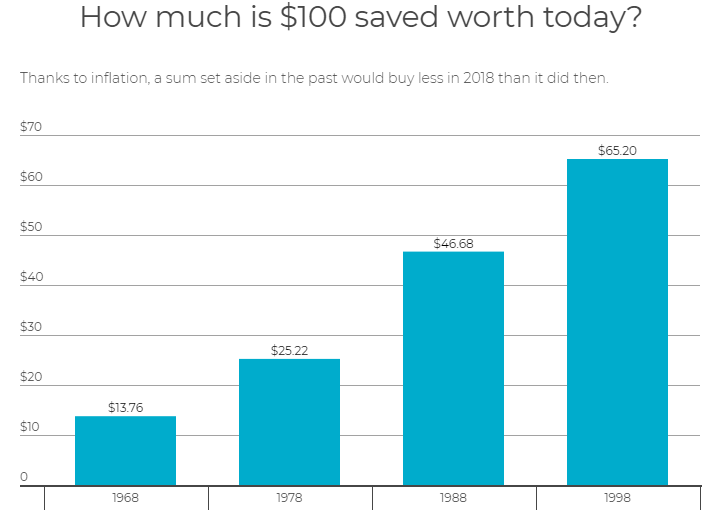

Over time, the money you save will actually lose value due to inflation. For example, $100 saved in 1998 was worth only $65.20 just 20 years later.

(Source: Nerdwallet)

With saving, you lose value because the account typically has a small interest rate relative to inflation. The purpose of saving is to have a nest egg that can be easily accessed when needed. By comparison, investing allows your money to grow over time, assuming you don’t need to draw from it before retirement.

While only 14% of Americans have direct investments in individual stocks, 52% have some level of investment such as a 401(k). This means nearly half of Americans aren’t investing, as many see it as too risky. On the contrary, inflation shows us that you are guaranteed to lose value if you choose to put money in a savings account rather than invest for retirement — so make sure you prioritize investing for retirement.

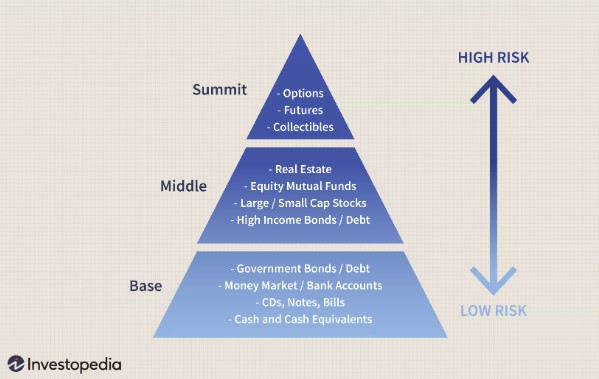

Depending on your goals, you can choose the level of risk you wish to take on when investing. If you want to retire early or want a larger sum, you may opt for a retirement investing strategy that carries a higher risk for a potentially higher reward. On the other hand, you could choose investment options that have a lower rate of return, but are generally considered safer.

For reference, here is a visual guide to the level of risk typically associated with common types of investments:

(Source: Investopedia)

If you aren’t familiar with investing, we recommend you find a professional to help create a strategy tailored to your goals and preferred risk level. There are two main approaches that they’ll walk you through to help build a portfolio:

Income Investing

Income investing focuses on generating the income you’ll need to cover living expenses from the interest and dividends that are generated from your account. For example, if you have an investment account worth $400,000 and it produces a 7% rate of return each year, it would gain $28,000 in value annually. Thus, you could take the $28,000 of interest/dividends and use it to cover your living expenses without having to take money from the principal balance.

Total Return Investing

Whereas income investing focuses on generating income solely from interest and dividends on the principal, total return investing aims to generate a target return from all sources (interest, dividends, selling securities, etc…). Basically, with total return investing you set a goal of how much money you want to gain from your return, and you see how much you make from interest and dividends, then make up the difference by rebalancing (buying and selling assets) your portfolio as needed. If you make enough from interest and dividends alone — you may not need to touch the account, but if you don’t, then you can always sell off and purchase assets to achieve your target return.

When creating your retirement investment strategy, keep in mind that your financial situation is subject to change depending on how far in advance you’re creating this plan. While most retirement income calculators tell you how much you can put towards retirement right now, you should adjust your contribution as your financial situation changes. For example, you may want to increase your contribution after receiving a raise so you can retire earlier. Keep this in mind when creating your plan, and be sure to update it to scale with your income.

Step 4: Identify recurring sources of retirement income

Just because you stop working doesn’t mean you still won’t have money coming in. There are several sources of fixed income you should account for when creating your retirement strategy:

Investment Returns

As discussed earlier, investment returns will be one of the most important sources of income during your retirement. Depending on how much is invested and the strategy a person chooses, returns from individual to individual will vary significantly. Most experts suggest using a 5-7% rate of return for your portfolio, but if you aren’t sure — air on the side of caution and underestimate so you don’t end up short in retirement.

Social Security

Social security is a crucial part of how seniors cover retirement expenses right now, and the SSA features a quick and easy calculator that shows your full retirement age (which is when you become eligible for unreduced social security benefits). The tool even provides information on the amount your spouse would be eligible for if you were the wage earner. In February 2023, the average social security benefits check was $1,782 per month. However, it’s important to note that many experts worry that social security will actually go bankrupt by 2035 unless significant changes are made for the system, so make sure you have a backup plan.

Pension(s)

Pensions have become less common recently, but if you have one then you’ll definitely want to account for it in your retirement income plan. Read the details of your pension plan carefully so you can accurately estimate income based on when you plan to take it. If you’re married, make sure to include information for the survivor option you elected.

Annuity Income

If you’re worried about outliving your savings and decide to purchase an income annuity, you’ll want to include the monthly benefit amount in your retirement income plan. The details of your annuity can be complex, so you may want to consider using an annuity calculator to assist with this process.

Step 5: Develop a withdrawal plan that includes taxes

When you withdraw money from your investment account to cover expenses in retirement, you’ll lose a portion of these funds to cover taxes and inflation. Don’t worry, the benefit of investing is to plan for these expenses in advance so your return covers these costs with extra money when you do withdraw funds.

Because your situation will be unique based on your investment strategy and assets, it’s recommended to work with a financial advisor to create this plan. Typically, they’ll recommend that you withdraw from taxable accounts first, then tax deferred accounts, followed by tax exempt accounts. We’ve provided a breakdown of these accounts below:

Taxable Accounts

With a taxable account, you pay taxes each year on the investment income you gain from assets such as stocks, bonds, and mutual funds. These are also known as “traditional” investment accounts who are offered by a brokerage.

Tax Deferred Accounts

With a tax deferred account, you pay taxes only when you withdraw money. Common examples of tax deferred accounts are traditional IRAs and 401(k)s.

Tax Exempt Accounts

With tax exempt accounts, you make contributions with after tax dollars and don’t need to pay any taxes when you withdraw the funds in retirement. The benefit here is that the funds can grow tax-free over a long-term period. So if you take $100 of after tax dollars from your paycheck and put it in a tax exempt account such as a Roth IRA or Roth 401(k), you won’t need to pay any taxes on the base amount or interest gained when you decide to withdraw it.

The goal of an investment withdrawal plan is to allow the assets with the least amount of tax to grow as long as possible. In some cases, your financial advisor may instead opt to withdraw a small amount of money from each account which results in a more stable tax bill over retirement.

Step 6: Determine if you’ll want to sell your life insurance for a lump cash sum

One final thing to consider when creating your retirement income plan — is whether you’ll want to maintain your life insurance policy or sell it to help cover living expenses. A lot of people take on life insurance policies while raising a family to provide financial security for loved ones in case of emergency, but in retirement you may not need the policy anymore because children are independent and you’ve built savings to provide for your partner.

High life insurance premiums may be deemed as an unnecessary expense when you’re older, which is why some people let their policy lapse or surrender it for an amount that is significantly less than your policy’s face value. If you do decide you don’t need life insurance anymore, selling it through a life settlement is a far better option that can yield a return worth up to 60% of the full death benefit amount.

With a life settlement, you can work with a third-party company that will help sell your policy to investors. In exchange, you’ll receive a large cash sum and you will no longer be responsible for paying monthly insurance premiums. The money you receive can be used however you’d like, which allows you to make the most of your golden years and cover retirement expenses. If you’re interested in this option, check out Harbor Life Settlements’ calculator to find out how much your policy could be worth.

If you have additional questions about life settlements, contact Harbor Life Settlements and receive a free, no-obligation, consultation. At Harbor Life Settlements, we use our connections with providers to help get you a fast, fair offer for your policy. You are free to walk away at any point, but if you decide to sell, we’ll do all the legwork so you can rest easy and start planning how to spend your money. Contact us to learn more.